Starting a business comes with various financial considerations, including taxes. To optimize your tax savings, it’s important to explore different strategies and entities. One such entity is an S Corporation (S corp), which offers unique tax advantages. In this blog post, we will delve into what S corps are, how they help you save money on taxes, provide an example of S corp tax savings calculation, discuss the advantages and drawbacks of starting an S corp, address common FAQs about S corps, and summarize key takeaways for your consideration.

What Are S Corps?

An S corp is a business entity that combines the liability protection of a corporation with the tax benefits of a partnership or sole proprietorship. Governed by Subchapter S of the Internal Revenue Code, S corps are favored by many small to mid-sized businesses for their tax advantages and flexibility.

How Do S Corps Help You Save Money On Taxes?

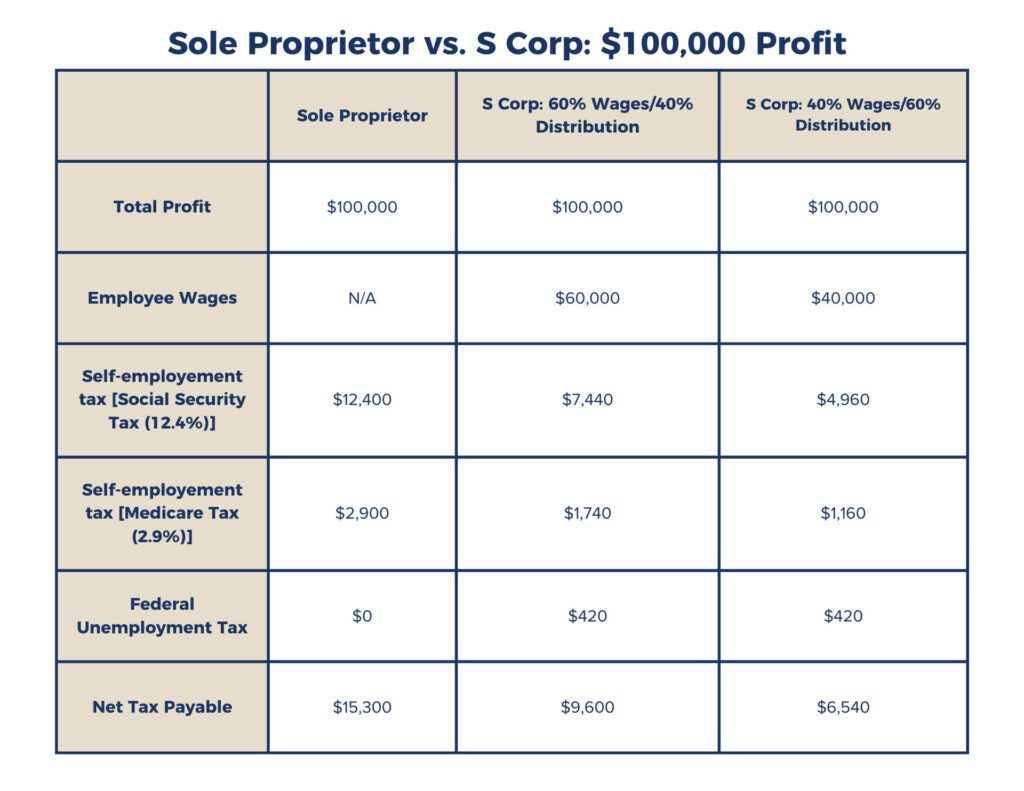

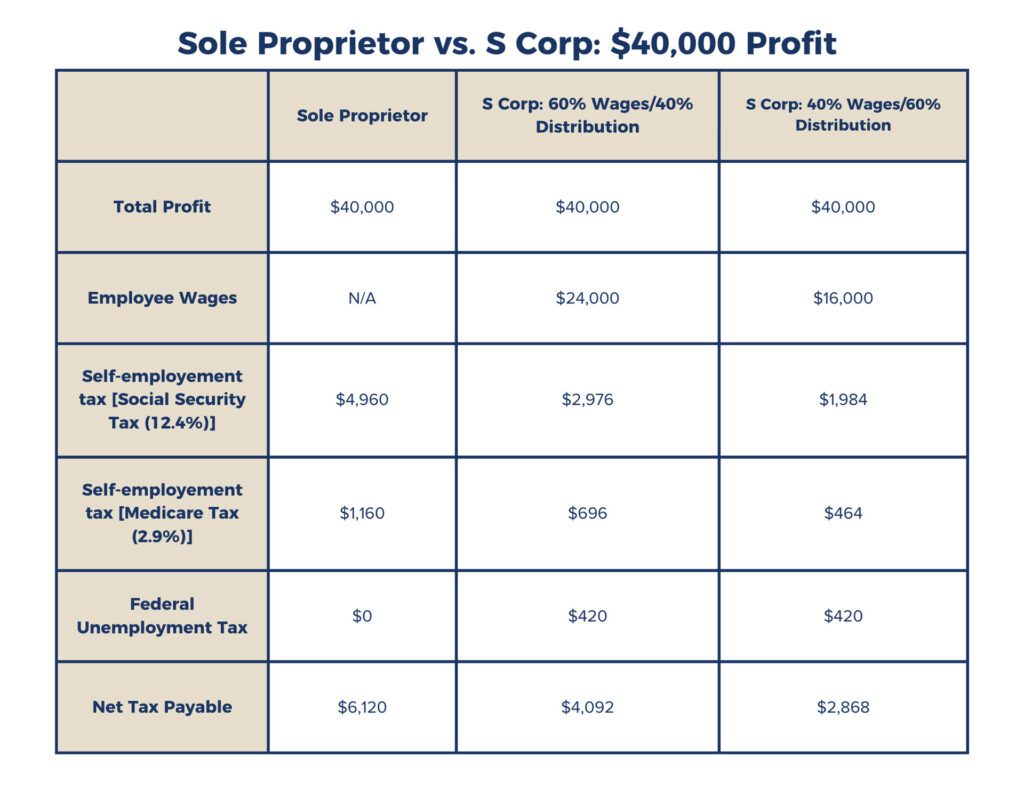

One key benefit of an S corp is the ability to minimize self-employment taxes. By dividing your income into salary and distributions, you can reduce the portion subject to self-employment taxes. This strategy allows you to decrease your overall tax burden and retain more profits within the business.

Example of S Corp Tax Savings Calculation:

Let’s consider an example to illustrate the potential tax savings with an S corp. Suppose your business generates $200,000 in annual profits. As a sole proprietor, you would pay self-employment taxes on the entire amount. However, by forming an S corp and structuring your income, you can significantly reduce your self-employment tax liability. For instance, if you designate a reasonable salary of $100,000 and distribute the remaining $100,000, you would only pay self-employment taxes on the salary portion, resulting in substantial tax savings.

Advantages of Starting an S Corp:

- Tax savings: S corps allow for the separation of salary and distributions, leading to potential self-employment tax savings.

- Limited liability protection: Like corporations, S corps provide limited liability protection, safeguarding your personal assets.

- Credibility and structure: Operating as an S corp can enhance your business’s credibility and professionalism, potentially attracting more clients and partners.

- Transferability and continuity: S corps offer ease of ownership transfer and greater continuity, allowing for seamless succession planning or future sale of the business.

Drawbacks of S Corps:

- Compliance requirements: S corps have stricter compliance obligations compared to sole proprietorships or partnerships, involving regular meetings, documentation, and record-keeping.

- Ownership restrictions: S corps have limitations on the number and type of shareholders, potentially limiting your flexibility in raising capital or expanding ownership.

- Additional costs: Establishing and maintaining an S corp involves certain expenses, such as filing fees and administrative overhead.

S Corp FAQs:

- Who can form an S corp? Domestic corporations, eligible LLCs, and partnerships meeting specific requirements can elect S corp status. Consulting with a tax professional or attorney is crucial to determine eligibility.

- Are there limitations on the number of shareholders? S corps can have up to 100 shareholders, who must be U.S. citizens or residents and not other corporations or partnerships.

- Can an S corp have different classes of stock? No, S corps can only have one class of stock, ensuring equal distribution of profits and preventing complex ownership structures.

Key Takeaways:

- S corps offer significant tax advantages by allowing for the separation of salary and distributions.

- Careful income structuring can lead to substantial self-employment tax savings.

- S corps provide limited liability protection, credibility, transferability, and continuity.

- Compliance requirements, ownership restrictions, and additional costs should be considered when deciding to form an S corp.

- Seek professional advice to ensure compliance and optimize tax savings for your business.

Reach out to the professionals at Coastal Tax for expert assistance in determining the best tax strategy and structure for your business. We are here to help you optimize tax savings and ensure compliance with regulations. Contact us today at (843) 549-5561 to get started.